Introduction to Accounting Software in Nepal

Accounting software has become an essential tool for businesses in Nepal, helping to manage finances, track transactions, and ensure tax compliance. With the rising number of small and medium-sized enterprises (SMEs), the demand for reliable and user-friendly accounting systems is increasing.

Why Businesses in Nepal Need Accounting Software

Businesses in Nepal face challenges in managing cash flow, staying tax compliant, and maintaining accurate financial records. Accounting software simplifies these tasks, ensuring transparency and helping entrepreneurs focus on growth.

Key Features to Look for in an Accounting Tool

When selecting an accounting tool, key features to consider include VAT/TDS management, invoicing, inventory tracking, multi-user access, cloud support, and integration with banking systems.

Top Accounting Software in Nepal

1. Tally Accounting Software

Tally is a well-known accounting software used globally and widely adopted in Nepal for VAT, inventory, and payroll management.

Price of TallyPrime License Price in Nepal

TallyPrime Gold 7.0 – Perpetual License

(Multi-User | Remote Access Enabled)

License Type | Price (NPR) |

|---|---|

Single Login License | 46,000.00 |

Multi Login License | 130,000.00 |

✔ Unlimited Companies, Users & PCs

✔ Unlimited multiple instances on LAN

✔ Remote access supported

✔ One-time purchase (Perpetual License)

Tally on Cloud (Recurring Pricing)

Access your Tally data securely anytime, anywhere with cloud hosting.

Plan | Monthly Price (NPR) |

|---|---|

One User | 2,800.00 / month (Excl. VAT) |

Two Users | 2,800.00 / month (Excl. VAT) |

✔ 24×7 private & secure access

✔ Ideal for remote teams and startups

✔ Cloud backup available during TSS validity

Renewal of Tally is compulsory for cloud backup.

Optional Add-On Modules (One-Time Cost)

Module | Price (NPR) | Description |

|---|---|---|

Voucher Approval Module | 15,500.00 (Excl. VAT) | Secure voucher approval workflow |

Document Management System | 84,000.00 (Excl. VAT) | Attach documents for audit & evidence |

Standard Payroll Module | 36,500.00 (Excl. VAT) | Payroll, tax, loan & advance deductions |

Purchase Indent Module | 18,700.00 (Excl. VAT) | Internal requisition & purchase tracking |

✔ Checker – Maker – Approver system

✔ Improved control and data security

Advanced & Enterprise Features

Unlimited companies, users & PCs

10 remote users over own VPN server (same subnet)

2nd user access via TSS

Data entry from PC or report view via browser

Internal requisition tracking to PO & purchase bill

Multiple instances on LAN

Implementation & Training

✔ Basic Chart of Accounts Implementation

✔ User Training Included

✔ Advance implementation charges will be quoted after system study (if required)

Warranty, Service & Renewal

Warranty, Service, TSS, and TallyPack valid for 12 months

Cloud backup available till TSS validity or first year of purchase/upgrade

Renewal required for continued cloud and support services

2. Swastik Accounting System

A locally developed solution, Swastik is tailored for Nepali businesses, supporting VAT billing, stock management, and taxation features.

3. Reach Accountant Nepal

This cloud-based software helps manage accounting, CRM, billing, and inventory from any device with internet access.

4. Marg ERP Software

Ideal for distribution and retail businesses, Marg ERP offers features like GST, accounting, invoicing, and reporting.

5. Busy Accounting Software

Busy offers a comprehensive solution for accounting, billing, inventory, and taxation for businesses of all sizes.

6. FinPOS Nepal

Specifically designed for restaurants and retail outlets, FinPOS integrates accounting with point-of-sale features.

7. QuickBooks Nepal (Cloud-Based Option)

QuickBooks offers robust cloud accounting tools and is ideal for service-based companies and consultants.

Comparison of Best Accounting Software in Nepal

Pricing and Packages

Costs vary depending on features and user licenses. Swastik and FinPOS are affordable for small businesses, while Tally and QuickBooks may be more expensive but offer greater functionality.

Features and Functionalities

All software options provide basic accounting features. Advanced options like automated billing, analytics, and third-party integrations are available in premium versions.

User Interface and Ease of Use

QuickBooks and Reach are known for intuitive design, while Tally and Marg ERP may require training.

Local Support and Customization

Swastik and FinPOS offer strong local support and features aligned with Nepali tax laws.

How to Choose the Right Accounting Software for Your Business

Business Size and Industry Type

Retailers may prefer FinPOS, manufacturers could go with Marg ERP, while service-based firms might choose QuickBooks or Reach.

Cloud-Based vs. Desktop Software

Cloud-based solutions like Reach and QuickBooks provide flexibility. Desktop-based software like Tally may be preferred for data control.

Importance of VAT and TDS Compliance in Nepal

Ensure the software you select supports updated VAT/TDS structures in Nepal to avoid compliance issues.

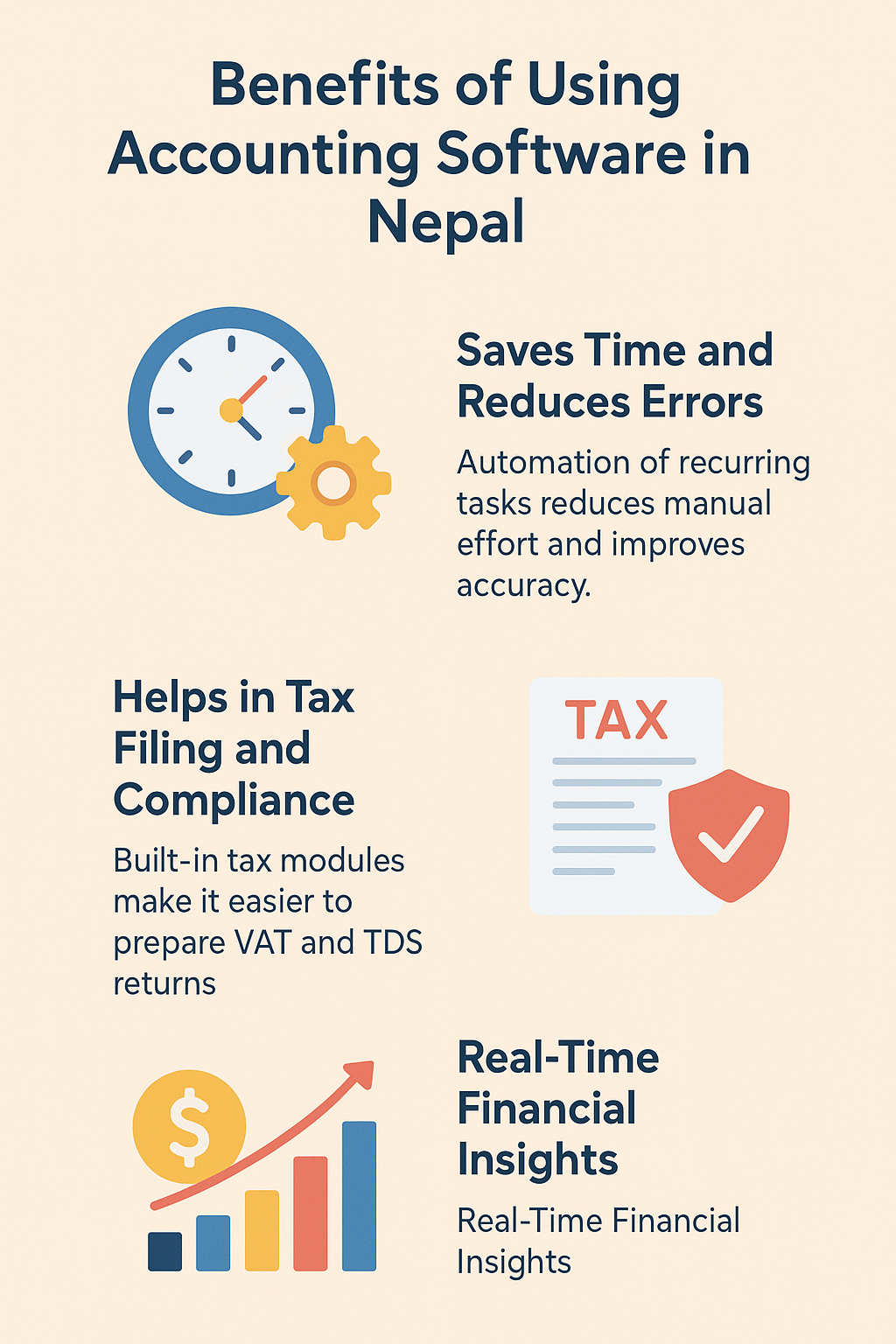

Benefits of Using Accounting Software in Nepal

Saves Time and Reduces Errors

Automation of recurring tasks reduces manual effort and improves accuracy.

Helps in Tax Filing and Compliance

Built-in tax modules make it easier to prepare VAT and TDS returns.

Real-Time Financial Insights

Dashboards and reports help businesses make informed decisions faster.

Providing Accounting Services to Small Businesses in Nepal

Importance of Accounting Services for Small Enterprises

Small businesses often lack in-house accounting staff, making external accounting support critical.

Common Accounting Challenges Faced by Small Businesses

Issues include poor record-keeping, lack of financial planning, and delayed tax filings.

Role of Professional Accountants in Business Growth

Accountants help small businesses stay compliant, save money, and plan for growth.

Key Accounting Services for Small Businesses

Bookkeeping and Record Keeping

Accurate records of income, expenses, and cash flow are maintained.

Financial Statement Preparation

Preparation of profit and loss statements, balance sheets, and cash flow reports.

VAT and TDS Filing Services

Assistance in timely filing of VAT and TDS as per IRD requirements.

Payroll Management

Handling employee salaries, PF/SSF contributions, and tax deductions.

Budgeting and Cash Flow Management

Helping clients manage spending and maintain liquidity.

Benefits of Outsourcing Accounting Services in Nepal

Cost-Effective Solution for Small Business Owners

Outsourcing reduces the cost of hiring full-time staff.

Access to Expert Financial Advice

Clients receive professional insights on tax planning and business strategy.

Better Focus on Core Business Activities

Owners can focus on operations while professionals handle financial tasks.

How to Start an Accounting Service for Small Businesses

Legal Requirements and Registration in Nepal

Register your business, obtain a PAN/VAT number, and comply with relevant laws.

Tools and Software You’ll Need

Invest in licensed accounting software, data security tools, and communication platforms.

Building Trust and a Client Base

Start with referrals, offer free consultations, and build your reputation through reliability.

Tips for Delivering Quality Accounting Services

Understanding Each Client’s Business Needs

Customized solutions add more value to clients.

Staying Updated with Tax Laws and Regulations

Regular training and updates are essential to stay compliant.

Ensuring Data Security and Confidentiality

Use encrypted software and sign NDAs with clients to protect data.

Final Thoughts on Accounting Software in Nepal

Best Pick for Small to Medium Enterprises

Swastik and FinPOS offer excellent local value for SMEs.

Recommendation for Large Enterprises and Corporates

Tally, Marg ERP, or QuickBooks are better suited for complex accounting needs.

Whether you're a business owner or an accountant, choosing the right software and services can significantly impact your financial clarity and compliance in Nepal.

Need help managing your accounts?

Estartup Nepal specializes in providing reliable bookkeeping and accounting services to SMEs across Nepal. From transaction recording to VAT filing, we handle it all—so you can focus on growing your business.

📞 Contact our team today to simplify your accounting process!