Understanding Share Loans in Nepal

What Is a Share Loan?

A share loan is a type of loan provided by banks and financial institutions where individuals or investors can borrow money by pledging their shares (stocks) as collateral. This type of financing allows investors to access funds without selling their investments, helping them take advantage of market opportunities or meet liquidity needs.

Importance of Share Loans in the Capital Market

Share loans play a significant role in supporting investment activities in the Nepal Stock Exchange (NEPSE). They provide flexibility for investors, increase market participation, and help maintain liquidity in the stock market. However, such loans are regulated by Nepal Rastra Bank (NRB) to ensure financial stability and prevent excessive market speculation.

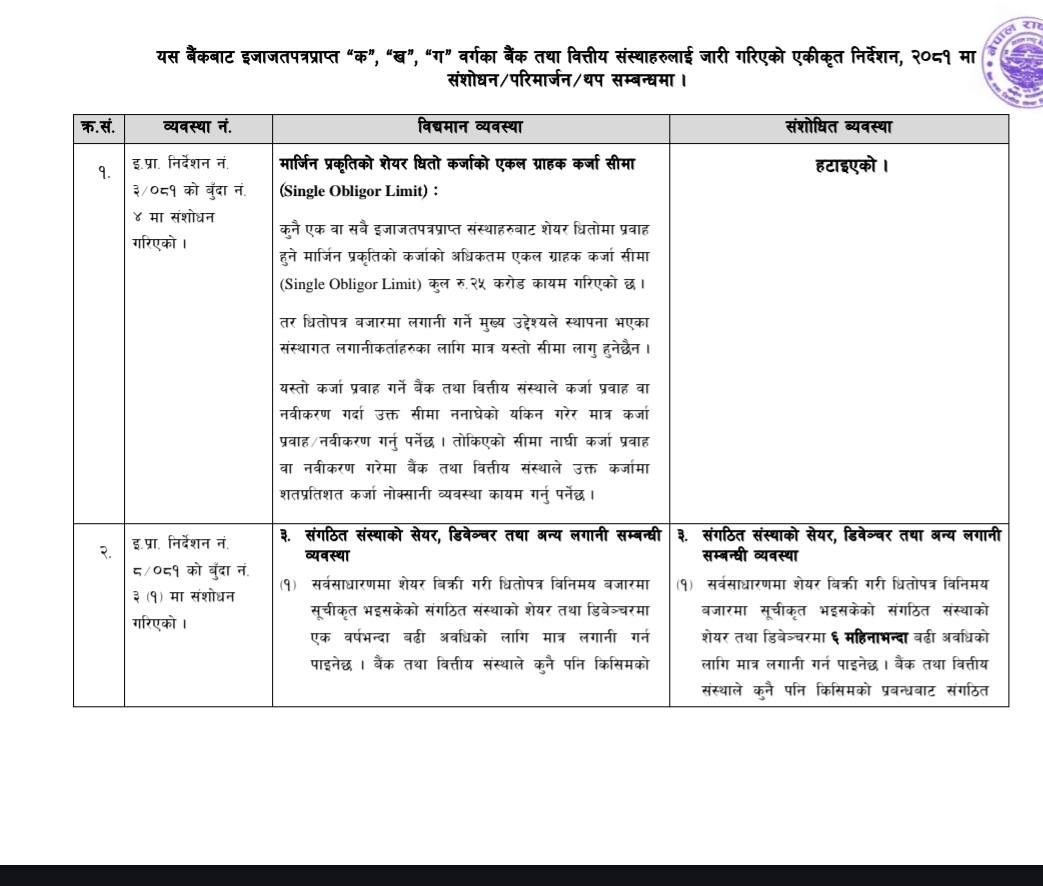

Nepal Rastra Bank Removes Share Loan Limit for Individuals

Rs. 25 Crore Share Loan Cap Lifted

Nepal Rastra Bank (NRB) has officially removed the Rs. 25 crore limit that banks could previously provide to individuals as share loans. This change aims to promote more flexible investment opportunities and enhance access to finance for investors.

Decision Based on Task Force Recommendations

The directive follows recommendations made by the Capital Market Reform Task Force, formed under former Finance Secretary Rameshwor Khanal. The decision aligns with NRB’s strategy to make Nepal’s capital market more dynamic and investor-friendly.

New Provisions for Bank Investment in Shares and Debentures

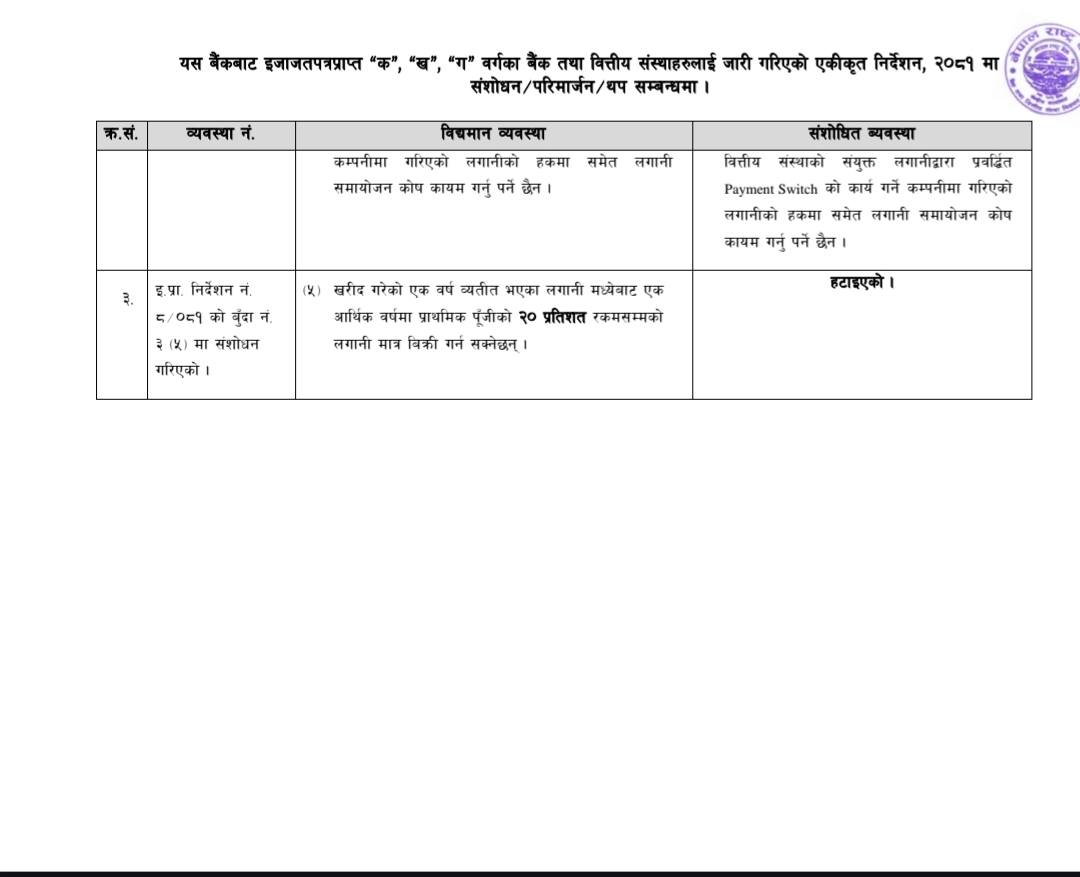

Removal of 20% Sales Restriction

Earlier, banks could sell only up to 20% of their share investments (based on primary capital) in a fiscal year if those shares had been held for more than one year. Nepal Rastra Bank has now removed this restriction, allowing banks greater flexibility in managing their investment portfolios.

Banks Can Invest for More Than Six Months

Banks are now allowed to invest in shares and debentures of listed institutions for a period of more than six months. Previously, banks could only invest if they held such assets for over one year. This revision is expected to make financial institutions more active participants in the capital market.

Impact on Nepal’s Capital Market

Boost in Market Liquidity and Investor Confidence

With the lifting of share loan limits and investment restrictions, the Nepalese capital market is expected to see improved liquidity, stronger institutional participation, and greater investor confidence.

Strengthening Financial Sector Growth

These regulatory changes align with Nepal Rastra Bank’s long-term vision of promoting sustainable financial development, enhancing efficiency in banking operations, and supporting economic growth through a stronger capital market ecosystem.

Check the extract of the directive: