Obtaining an Personal Tax Clearance Certificate is an important process to verify your income and tax compliance in Nepal. This certificate is commonly required for purposes such as visa processing, business transactions, loan approvals, or official financial documentation.

Here’s a complete guide on the documents required, application process, and deductions allowed for natural persons under Nepal’s tax system.

What is a Personal Tax Clearance Certificate?

An Personal Tax Clearance Certificate is an official document issued by the Inland Revenue Office of Nepal. It certifies that an individual has filed income tax returns, declared income and expenses accurately, and complied with tax laws for the relevant fiscal year.

Documents Required for Personal Tax Clearance Certificate

To apply for a taxpayer certificate, the following documents must be submitted to the tax office:

1. Annual Income and Expenditure Statement

A copy of the annual income and expenditure statement for the relevant fiscal year must be submitted, verified by the concerned tax office.

2. Proof of ETDS (Electronic Tax Deducted at Source)

You must provide proof of income and tax deducted at source (ETDS) under your Permanent Account Number (PAN), as certified by the Inland Revenue Office.

3. Application Letter

The applicant must submit an application letter including complete details of annual income and expenditure, requesting the issuance of the taxpayer certificate.

4. Authorization Letter (If Applicant Cannot Be Present)

If the applicant is unable to appear in person, they may authorize a family member or another individual to collect the certificate.

An authorization letter and all required supporting documents must be provided.

5. PAN Numbers of Husband and Wife

For natural persons, it is mandatory to provide the PAN numbers of both husband and wife to ensure accurate tax record linkage.

6. Bank Statement for Income Above NPR 25,000 per Month

From the fiscal year 2079/080 (2022/23), individuals receiving monthly income exceeding NPR 25,000 must submit a bank statement as proof of income.

Deductions Allowed for Natural Persons in Nepal

Understanding the deductions and exemptions available for natural persons helps in reducing taxable income and ensures accurate filing. The following deductions are allowed under Nepal’s Income Tax Act:

1. Basic Exemption Limit

For Fiscal Year 2082/83 (2025/25), the basic exemption limit for natural persons is as follows:

For Individuals: NPR 500,000 per annum

For Married Persons (Couples): NPR 600,000 per annum

Any income above this limit is subject to progressive tax rates.

2. Retirement Contribution (Social Security Fund)

Contributions made to the Social Security Fund (SSF) or an approved retirement fund are deductible up to one-third of assessable income or NPR 500,000, whichever is lower.

3. Life Insurance Premiums

Premiums paid on a life insurance policy are deductible up to NPR 40,000 per annum. This deduction helps individuals with financial planning while reducing taxable income.

4. Medical Insurance Premiums

A medical insurance premium paid for self, spouse, or dependent family members is deductible up to NPR 20,000 per annum.

5. Remote Area Allowance

Individuals working in remote areas of Nepal are eligible for remote area tax rebates as per the government’s specified list of districts.

This deduction ranges from 10% to 35% of taxable income, depending on the area classification.

6. Disability and Senior Citizen Deduction

Persons with disabilities receive an additional 50% tax exemption on the basic exemption limit.

Senior citizens (aged 60 and above) are also entitled to special deductions or lower tax rates under the Income Tax Act.

Why the Tax Clearance Certificate Matters

Having an Personal Tax Clearance Certificate proves that you are a registered taxpayer and have complied with all tax requirements for the fiscal year. It is essential for:

Applying for bank loans or financial facilities

Visa and foreign employment documentation

Business registration or renewal

Participating in government tenders and contracts

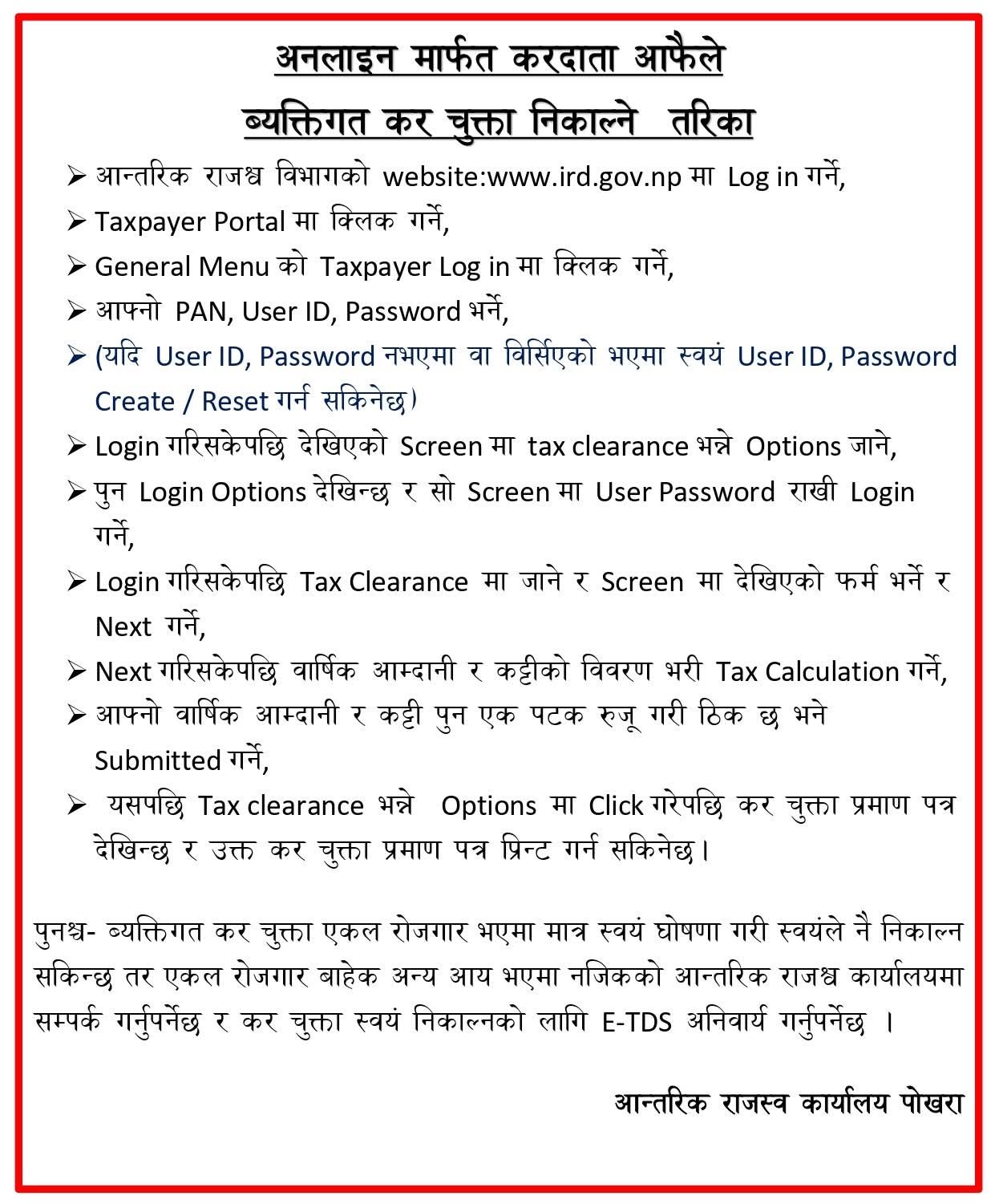

How to Download Personal Tax Clearance Certificate Online

Log in to the website of the Inland Revenue Department: www.ird.gov.np

Click on Taxpayer Portal

From the General Menu, click on Taxpayer Log in

Enter your PAN, User ID, and Password

(If you have forgotten your User ID or Password, you can create/reset them yourself.)

After logging in, go to the screen where you see the Tax Clearance option

If the system logs you out, log in again using the same screen with your user credentials

After logging in, go to Tax Clearance, fill out the form displayed on the screen, and click Next

On the next screen, enter your annual income and deductible details, and complete the Tax Calculation

Review your annual income and deduction details again and submit if everything is correct

After that, click the Tax Clearance option, where you can see the tax clearance certificate

You can print the displayed tax clearance certificate

Note:

A personal tax clearance certificate can only be obtained by self-declaring income if the taxpayer has income from a single job. For individuals with multiple employers or other sources of income, you must contact the Inland Revenue Office.

To self-generate tax clearance for such cases, E-TDS must be updated.

Conclusion

Obtaining an Personal Tax Clearance Certificate in Nepal is a straightforward yet vital step for any working individual. By submitting the necessary documents and understanding your eligible tax deductions, you can ensure compliance with Nepal’s tax system and maintain transparent financial records.