Introduction to Tax Filing in Nepal

Tax filing is a mandatory process for every individual and business entity in Nepal, as per the Income Tax Act, 2058. Every taxpayer must declare their income, expenses, and applicable taxes within the deadline set by the Inland Revenue Department (IRD).

However, due to operational delays, system errors, or incomplete financial documents, many taxpayers struggle to meet the regular deadline. To address this, the IRD occasionally grants an extension for tax filing in Nepal allowing taxpayers extra time to submit their returns without facing penalties or interest charges.

In this comprehensive guide, we’ll explore the latest tax filing deadlines, the extension process and practical tips to stay compliant and avoid late fees.

When Do You Need a Tax Filing Extension?

Even though tax filing is an annual routine, various factors can lead to delays. Understanding when to seek an extension can help you stay compliant and avoid unnecessary penalties.

Common Reasons for Requesting an Extension

Audit delays: Businesses often face delays in completing financial audits before the deadline.

Technical issues: Server downtime or e-filing system errors can prevent timely submission.

Incomplete documentation: Missing invoices, TDS details, or receipts may delay final reporting.

Unforeseen events: Illness, natural calamities, or lockdowns can affect the filing process.

Who Can Apply for an Extension?

Both individual taxpayers and registered organizations can apply for an extension if they are unable to submit returns on time. This includes:

Salaried employees with additional income sources.

Self-employed professionals (doctors, engineers, freelancers).

Registered firms and private limited companies.

NGOs and other institutions with taxable income.

The IRD reviews each request on a case-by-case basis before granting approval.

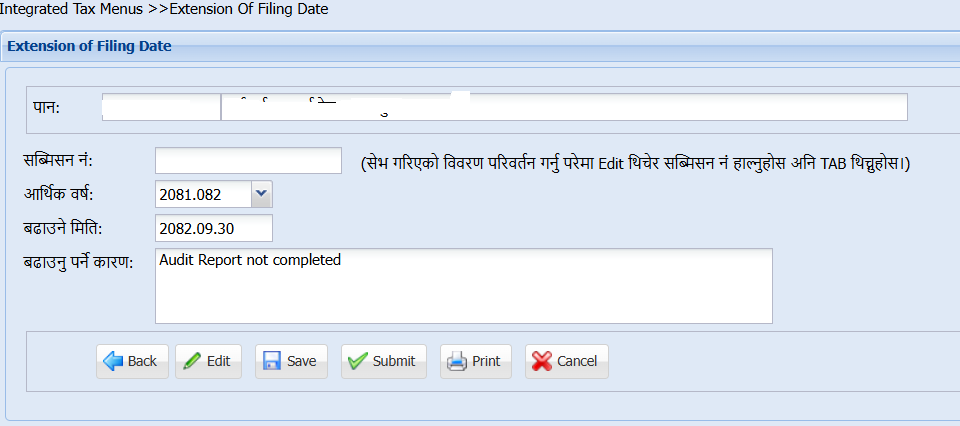

Process to Apply for a Tax Filing Extension in Nepal

The Inland Revenue Department (IRD) has a defined procedure for requesting a tax filing extension. Whether you’re an individual or a company, the process remains straightforward but requires timely action.

Step-by-Step Process

Prepare an application letter addressed to your local Inland Revenue Office (IRO).

Clearly state the reason for the delay (e.g., audit not completed, system issues).

Attach supporting documents, such as auditor’s letters, incomplete reports, or official justifications.

Submit the request before the original tax filing deadline.

Await official approval from the IRO or IRD.

Once the extension is granted, the taxpayer receives an official notification confirming the new deadline.

Online vs. Offline Submission

The IRD encourages digital communication through its online portal — www.ird.gov.np.

Online Submission: Taxpayers can log in to the IRD system, upload their application and documents, and track the status.

Offline Submission: If the system is down or inaccessible, you can submit the physical application to your local Inland Revenue Office.

This flexibility helps ensure compliance even in case of technical difficulties.

Latest Deadline for Tax Filing Extension

Each fiscal year, the Inland Revenue Department announces the tax filing deadline typically the end of Ashwin (mid-October). However, depending on public holidays, administrative reasons, or digital system issues, this deadline may be extended.

Extended Date for FY 2081/82

For Fiscal Year 2081/82, the IRD extended the filing deadline until end of Poush, 2082 (mid-January 2025).

This provided taxpayers with an additional three month grace period to complete their income tax filing returns.

The extension was particularly beneficial for small businesses and firms facing delays in completing their annual audits. However, it’s important to remember that the extension applies only to filing deadlines, not to tax payment deadlines, unless specifically mentioned by the IRD.

How to Stay Updated

The IRD regularly publishes official notices and circulars on https://www.ird.gov.np

Checking these updates ensures you never miss the latest changes to deadlines or new tax compliance rules.

Benefits of Filing Taxes on Time

Timely tax filing isn’t just a legal requirement and it also brings tangible benefits for individuals and businesses.

Key Advantages

Avoids penalties and interest: Save money and maintain a clean financial record.

Builds financial credibility: Important for loan applications, tender bids, and business registrations.

Enables refunds and carry-forward losses: Early filing ensures faster processing of refunds and loss claims.

Promotes transparency: Regular tax filing reflects good financial discipline and professionalism.

Filing within the extended deadline can also protect your business from unnecessary scrutiny and audits.

Digital Platforms for Tax Filing in Nepal

The IRD’s electronic filing system (e-filing) has transformed the way taxpayers submit their returns.

How to File Online

Log in with your PAN number and password.

Select your tax category (Income Tax).

Upload the required details and documents.

Click on Save.Then, Submit and Print for your purpose.

Benefits of E-Filing

24/7 accessibility and faster processing.

Reduced human error and paperwork.

Automatic validation of data.

Convenient record-keeping for future reference.

Digital filing is now mandatory for most registered taxpayers, ensuring efficiency and transparency.

Tax Filing Extension for Companies and Individuals

For Companies

Companies must submit their annual income tax return, VAT reports, and audit reports within the IRD’s specified timeframe.

If the audit report isn’t ready or the accountant needs more time, the company can request an extension by submitting an application through the Inland Revenue Office.

For Individuals

Self-employed professionals, freelancers, and landlords often face delays in collecting income details or TDS documents. They can also request an extension by providing valid reasons.

However, tax payment should still be completed by the original due date to avoid interest, even if the filing date is extended.

Tips to Avoid Future Tax Filing Delays

Proactive planning helps prevent last-minute stress and missed deadlines.

Practical Tips

Set automatic reminders one month before the IRD’s deadline.

Use accounting software like Xero, Tally, or Finsys to manage your books efficiently.

Maintain digital records of all receipts, invoices, and tax certificates.

Hire a professional accountant or tax consultant for guidance.

Regularly check the IRD website or subscribe to official updates.

By developing good financial habits, you can save time, reduce stress, and avoid penalties altogether.

Conclusion: Stay Compliant with Nepal’s Tax Filing Rules

Understanding the tax filing extension in Nepal ensures that individuals and businesses remain compliant with national tax laws. The Inland Revenue Department (IRD) provides flexibility by extending deadlines when needed, but taxpayers should always aim to submit their returns within the official timeframe.

Filing on time not only helps you avoid penalties but also enhances your business reputation and creditworthiness. Whether you’re a freelancer, business owner, or salaried employee, staying informed about the IRD tax deadlines, extension procedures, and digital filing systems will make your tax journey much smoother.

✅ Pro Tip: For professional help with remote bookkeeping, accounting, and tax filing in Nepal, you can contact info@estartupnepal.com for expert guidance and support.

Frequently Asked Questions (FAQs) on Tax Filing Extension in Nepal

1. What is a tax filing extension in Nepal?

A tax filing extension is additional time granted by the Inland Revenue Department (IRD) for taxpayers to submit their income tax returns after the original deadline. It helps individuals and businesses who face delays due to audits, technical issues, or incomplete documents.

2. How can I apply for a tax filing extension in Nepal?

To apply for an extension, you must:

Write an application letter to your local Inland Revenue Office (IRO) before the filing deadline.

Mention valid reasons for the delay.

Attach necessary supporting documents.

Submit the request either physically or through the IRD online portal (www.ird.gov.np).

Once approved, you’ll receive confirmation of the new extended deadline.

4. How can I avoid future tax filing delays?

To avoid delays:

Keep digital financial records throughout the year.

Use accounting tools like Xero or Tally for accurate bookkeeping.

Set up automatic reminders before IRD deadlines.

Seek advice from a professional tax consultant in Nepal.

Proactive planning will help you stay compliant and avoid last-minute stress.

✅ Final Tip:

If you need expert help with bookkeeping, accounting, or tax filing in Nepal, reach out to info@estartupnepal.com for reliable remote accounting services.