This article is useful for new businesses or startups who have incorporated their business and whose turnover has increased and are in dilemma what are the criteria to get registered in VAT from the taxation laws point of view. We all know that the company should obtain a Permanent account number (PAN) before commencing its business from the tax office where the business is located. If the business has reached the threshold of turnover or it is compulsory to be registered in VAT, the registered person should get registered in VAT within 30 days of obtaining such threshold.

Threshold for VAT Registration in Nepal

Let’s discuss, what are the conditions to be registered in VAT which is also known as threshold. The threshold for VAT registration is presented below:

1. For the business dealing in Goods only, the limit is 50 Lakhs Rupees Within last 12 Months

2. For the business dealing in Services only,the limit is 30 lakhs Rupees Within Last 12 Months

3.For the business dealing in both Goods & Services, the limit is 30 Lakhs Rupees Within Last 12 Months

Implications after getting registered in VAT

The business (registered taxpayer) should file the VAT return within 25 days after the completion of the month in general but the tax department has implemented a new filing period for small and micro businesses.

In case of failure to file of VAT return by the business, the tax department imposes fines and penalties based on the turnover of the business during the filing period.

Frequently Asked Questions for VAT in Nepal

What is VAT Registration in Nepal?

Value Added Tax (VAT) registration is the process by which businesses in Nepal register with the Inland Revenue Department (IRD) to collect and remit VAT on their sales of goods and services. VAT registration provides businesses with a unique VAT registration number that must be used on invoices and tax filings. The VAT registration process ensures businesses are compliant with Nepal’s VAT laws and enables them to claim input tax credits on their purchases.

Is VAT Registration compulsory in Nepal?

VAT registration is compulsory for businesses in Nepal that meet certain turnover thresholds or engage in specific types of business activities. However, not all businesses are required to register for VAT. The VAT Act 2052 (1996) outlines the criteria for mandatory VAT registration.

What companies must register for VAT in Nepal?

Certain types of businesses must mandatorily register for VAT in Nepal regardless of their turnover. These include:

Manufacturing industries

Import-export businesses

Hotels, restaurants and bars

Travel agencies and tour operators

Telecommunications service providers

Consulting firms

Accounting and auditing firms

Legal services

Educational consultancies

Healthcare facilities

Construction companies

Real estate developers

Advertising agencies

Event management companies

Security service providers

Additionally, businesses in other sectors that exceed the turnover thresholds are required to register for VAT.

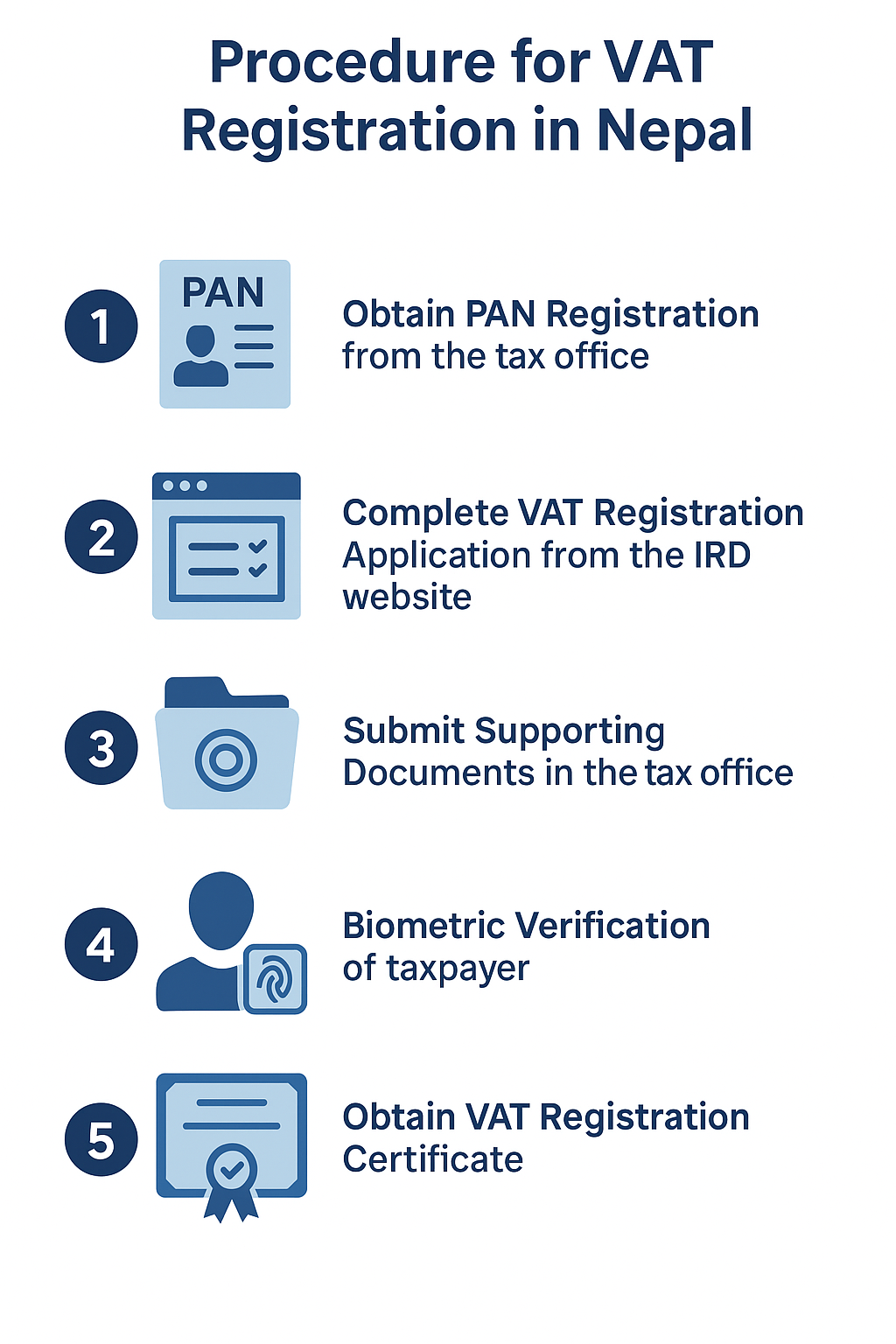

Procedure for VAT Registration in Nepal

Step 1: Obtain PAN Registration

Description: Before registering for VAT, businesses must first obtain a Permanent Account Number (PAN) from the Inland Revenue Department. PAN registration is mandatory for all businesses in Nepal.

Step 2: Complete Online VAT Registration Application

Description: Businesses can apply for VAT registration online through the IRD’s Taxpayer Portal. The online application requires details such as business information, estimated turnover, bank account details, and director/owner information.

Step 3: Submit Supporting Documents

Description: After completing the online application, businesses must submit supporting documents to their local Tax Office. This includes the company registration certificate, PAN certificate, and other relevant documents.

Step 4: Biometric Verification

Description: The business owner or authorized representative must visit the Tax Office in person for biometric verification. This involves capturing fingerprints and a photograph.

Step 5: Receive VAT Registration Certificate

Description: Upon successful verification and processing of the application, the Tax Office issues a VAT Registration Certificate with a unique 9-digit VAT number. This certificate must be prominently displayed at the business premises.

Documents required for VAT Registration in Nepal

Documents required for VAT Registration in Nepal

Completed VAT registration application form

Company registration certificate

PAN certificate

Memorandum and Articles of Association

Share certificates (for companies)

Citizenship certificates of directors/owners

Recent passport-size photographs of directors/owners

Rental agreement or proof of business premises ownership

Bank account details

Estimated financial statements/projections

Additional documents may be required depending on the nature of the business. All documents should be certified copies.

Timeframe for VAT Registration

The VAT registration process in Nepal typically takes 3-5 working days from the date of submitting a complete application with all required documents. However, the actual processing time may vary depending on the workload of the Tax Office and any additional verifications required.

Cost of VAT Registration in Nepal

There is no official government fee for VAT registration in Nepal. However, businesses may incur costs related to document preparation, notarization, and professional fees if using the services of consultants or lawyers for the registration process.

VAT Deregistration Process in Nepal

Businesses can apply for VAT deregistration if they no longer meet the turnover thresholds or cease operations. The deregistration process involves:

Submitting a written application to the Tax Office

Settling any outstanding VAT liabilities

Undergoing a tax audit

Receiving a deregistration certificate

Businesses must continue to comply with VAT regulations until the deregistration is approved.

Voluntary VAT Registration in Nepal

Businesses that do not meet the mandatory registration thresholds can opt for voluntary VAT registration. This may be beneficial for businesses that:

Deal primarily with VAT-registered customers

Want to claim input tax credits on purchases

Anticipate crossing the threshold soon

Wish to enhance their business credibility

The process for voluntary registration is the same as mandatory registration.

VAT registration is a critical compliance requirement for many businesses operating in Nepal. The registration process, while straightforward, requires careful preparation and submission of accurate information and documents. Businesses should assess their VAT registration obligations based on their turnover and nature of activities. Proper VAT registration enables businesses to legally collect VAT, claim input credits, and avoid penalties for non-compliance.

Cases Where VAT Deregistration is Required

Turnover Falls Below Mandatory Threshold

Businesses with annual taxable turnover below NPR 5 million can apply for VAT deregistration.

Business Closure or Dissolution

If you shut down your business permanently, you must cancel your VAT registration.

Change in Nature of Business

If you stop making taxable supplies or switch to fully VAT-exempt activities, deregistration is allowed.

Transfer or Merger of Business

When a business is sold, merged, or transferred, the old VAT registration can be cancelled, and the new entity must register separately if applicable.

Voluntary Deregistration

Voluntarily registered businesses can apply for deregistration after one year if turnover remains below the threshold.

Death of Sole Proprietor

For sole proprietorships, VAT registration is cancelled in the event of the owner's death unless the legal heir continues the business.

Deregistration by Tax Office

The IRD can cancel a VAT registration if:

The registration was obtained fraudulently.

The business has been inactive for a long time.

The taxpayer repeatedly fails to file returns or pay tax even after notices.

Step-by-Step Process for VAT Deregistration in Nepal

Step 1: Verify Eligibility

Confirm that you meet one of the deregistration criteria such as business closure, turnover below threshold, or voluntary cancellation after one year.

Step 2: File Pending VAT Returns

Submit all outstanding VAT returns up to the date of closure/cessation.

Pay any outstanding tax dues or claim input tax credit if available.

Step 3: Prepare Required Documents

You will need:

Online application form

PAN/VAT certificate copy

Latest VAT return and payment proof

Closure notice, merger agreement, or board resolution (if applicable)

Step 4: Apply Online Through IRD Portal

Visit IRD Taxpayer Portal

Log in with PAN/VAT credentials

Go to Taxpayer Request → VAT Deregistration

Fill details, upload documents, and submit

Step 5: IRD Verification

A tax officer will review your application, check your tax compliance, and may visit your business or conduct an audit.

Step 6: Receive Deregistration Certificate

Once approved, you’ll receive a VAT Deregistration Certificate online or from your tax office.

Step 7: Keep Records for 6 Years

Maintain VAT invoices and records for at least 6 years in case of a future audit.